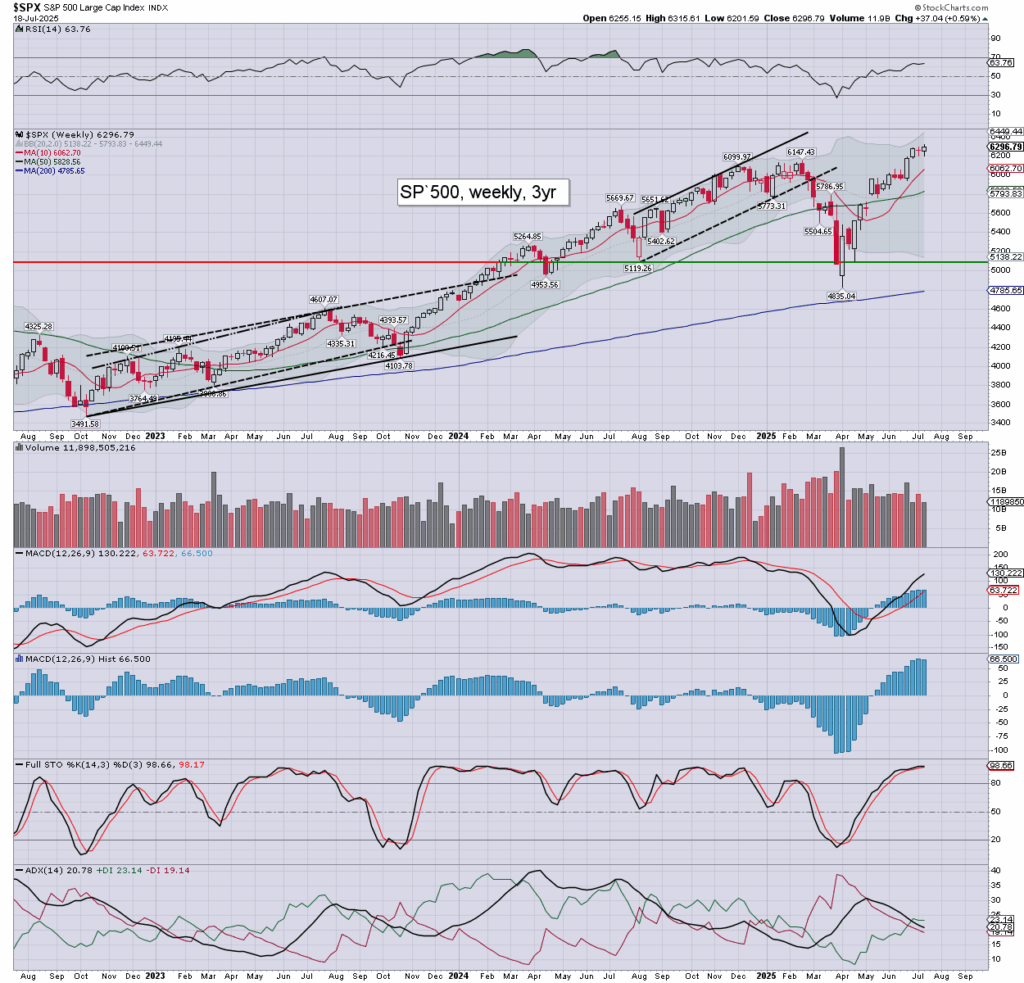

It was another net bullish week in equity land, with the SPX having printed a new historic high of 6315. The bigger weekly and monthly charts are both offering the 6400s, and around 6500 by Labor day.

Gross complacency?

Yes, the mainstream sentiment is grossly complacent about multiple economic and geo-political threats. The housing market isn’t great, and many companies are firing people by the thousand. There is Ukraine/Russia, Israel/Gaza, and lets not forget China/Taiwan.

For now though, Mr Market doesn’t particularly care. Instead… the market is hoping for rate cuts (and arguably renewed printing), not least once Powell has been replaced.

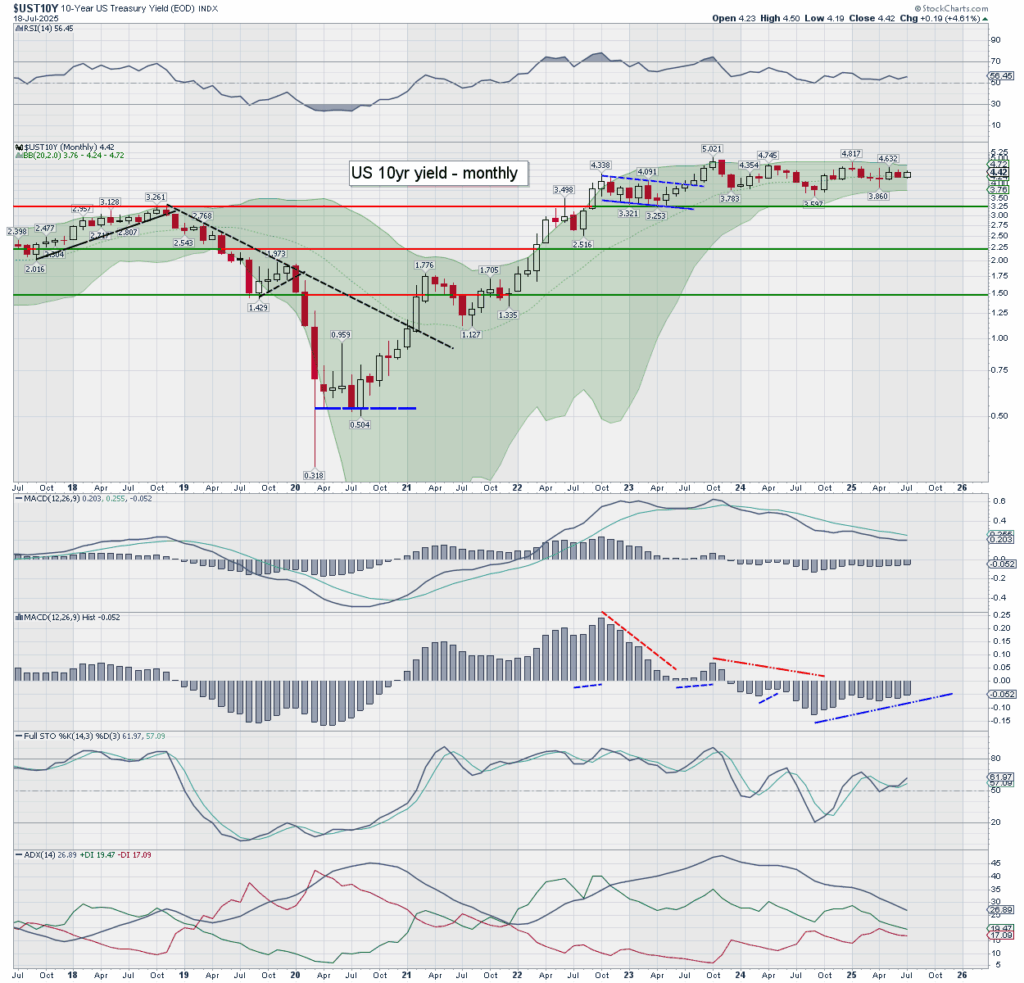

My concern into the Fall… is the bond market. Despite President Trump stating he wants interest rates to 1% or lower, I’d be mindful that the bond market might have other ideas.

The US 10yr yield stands at 4.42%. Broadly… its been chop for around three years, and I’d be the first one to state… bullish >5.00%, and bearish <3.25%

With the ‘big beautiful bill’, or arguably ‘abomination’, having been passed, annual deficits will remain high, with the federal debt mountain likely to hit $50trn by 2030/32.

My inclination is to see a bullish breakout in the US 10yr >5.00%, and then onward to 7%. If you think that is ‘crazy talk’, well, I refer you to Dimon of JPM, who appears also to be leaning in that direction.

Monthly momentum in yields is highly prone to turning positive in Sept’ or Oct’. If that happens, its difficult not to see >5.00%, in which case all aspects of the capital markets are going to have to adjust.

–

Two interesting things…

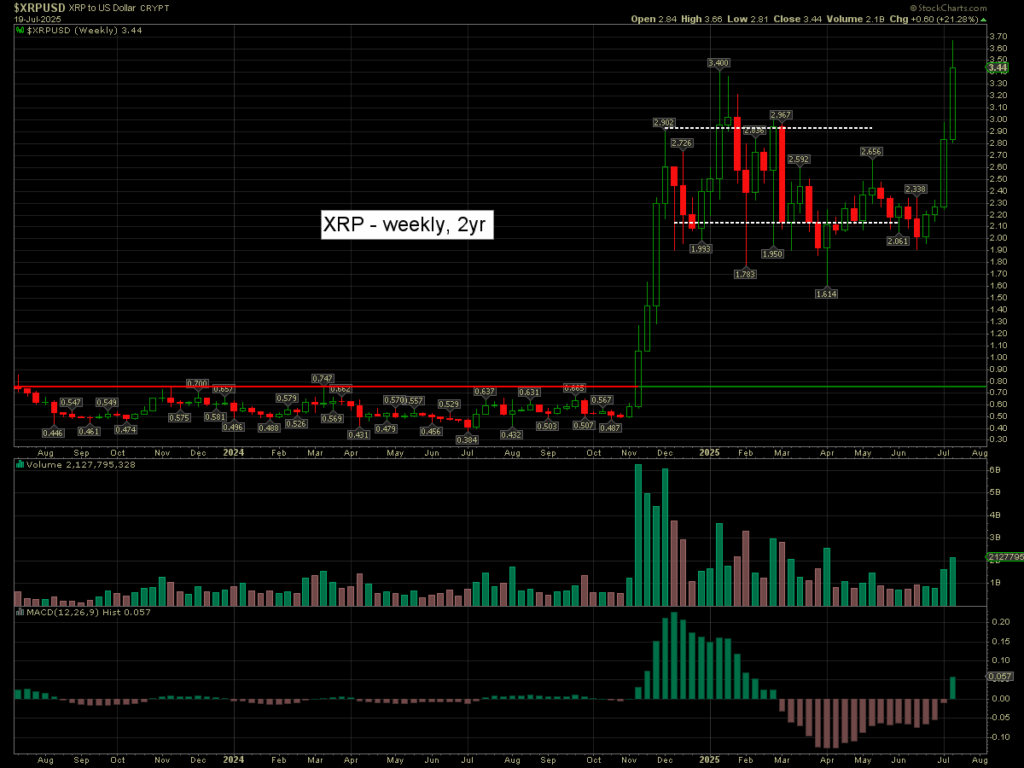

Crypto – XRP

XRP broke a new hist’ high of $3.66 on Friday. I’d note weekly momentum has turned positive for the first time since late February. A multi-month push to $10 looks an eventuality.

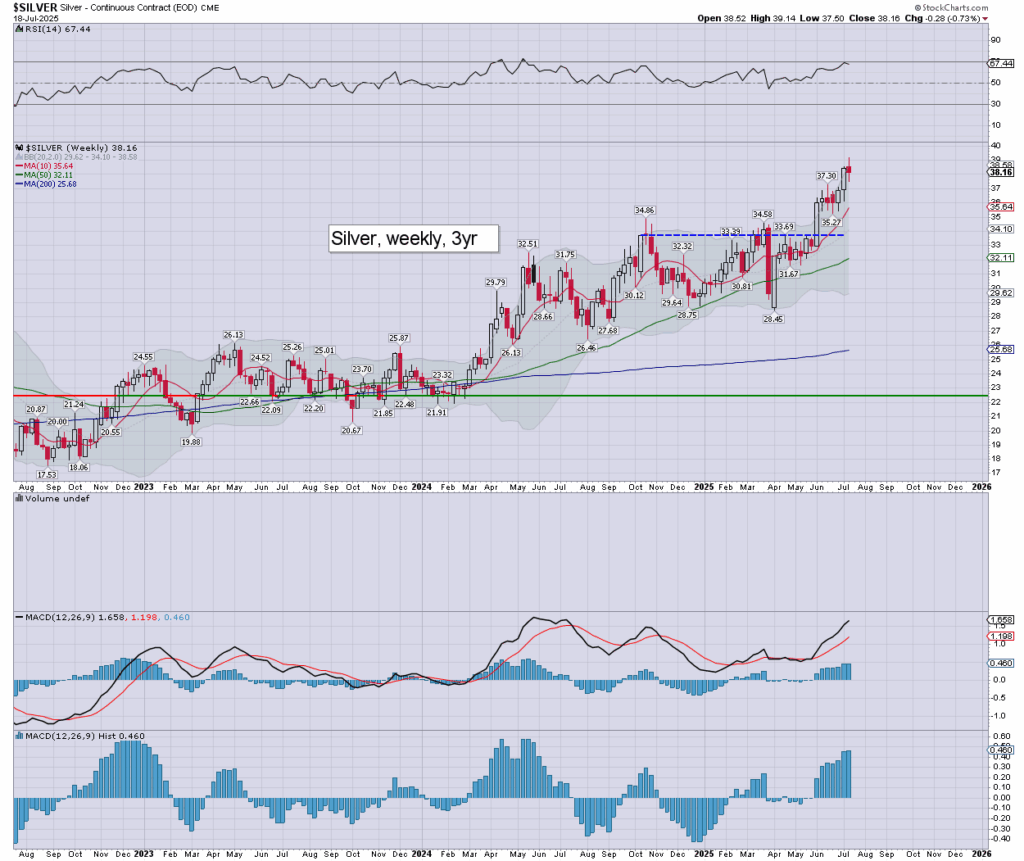

Commodities – Silver

This week saw silver print $39.14, the highest since Sept’2011. There is another 26% until a challenge of the 1980/2011 double top of the $49s.

–

Yours truly remains independent, which is a rarity these days. I’m not beholden to anyone, and I can call it as I see it. If you value such a thing, then now is the time to subscribe…

Subscription offers

6 months (+1 free) at $21 a month for $126

https://buy.stripe.com/4gM5kD7Zy4Dp0Xja3Absc04

12 months (+3 free) at $19 a month for $228

https://buy.stripe.com/5kQfZhcfO2vhdK5cbIbsc06

Notes:

-Payment is in one lump sum.

-Offers valid until midnight EST, Thurs’ July 31st 2025.

You’re welcome to also pay using Paypal, not least if you’d instead prefer a monthly subscription.

> https://www.tradingsunset.com/subscriptions

—

Yours… philip