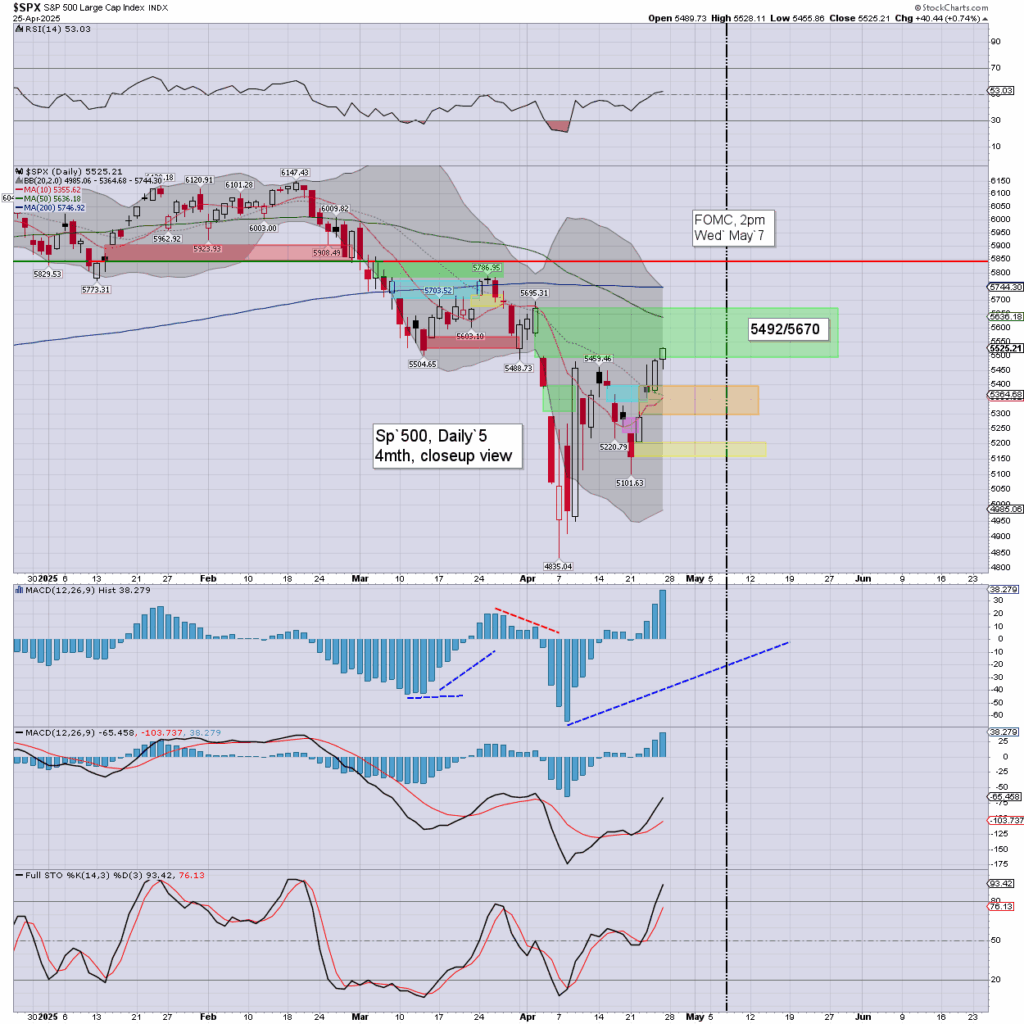

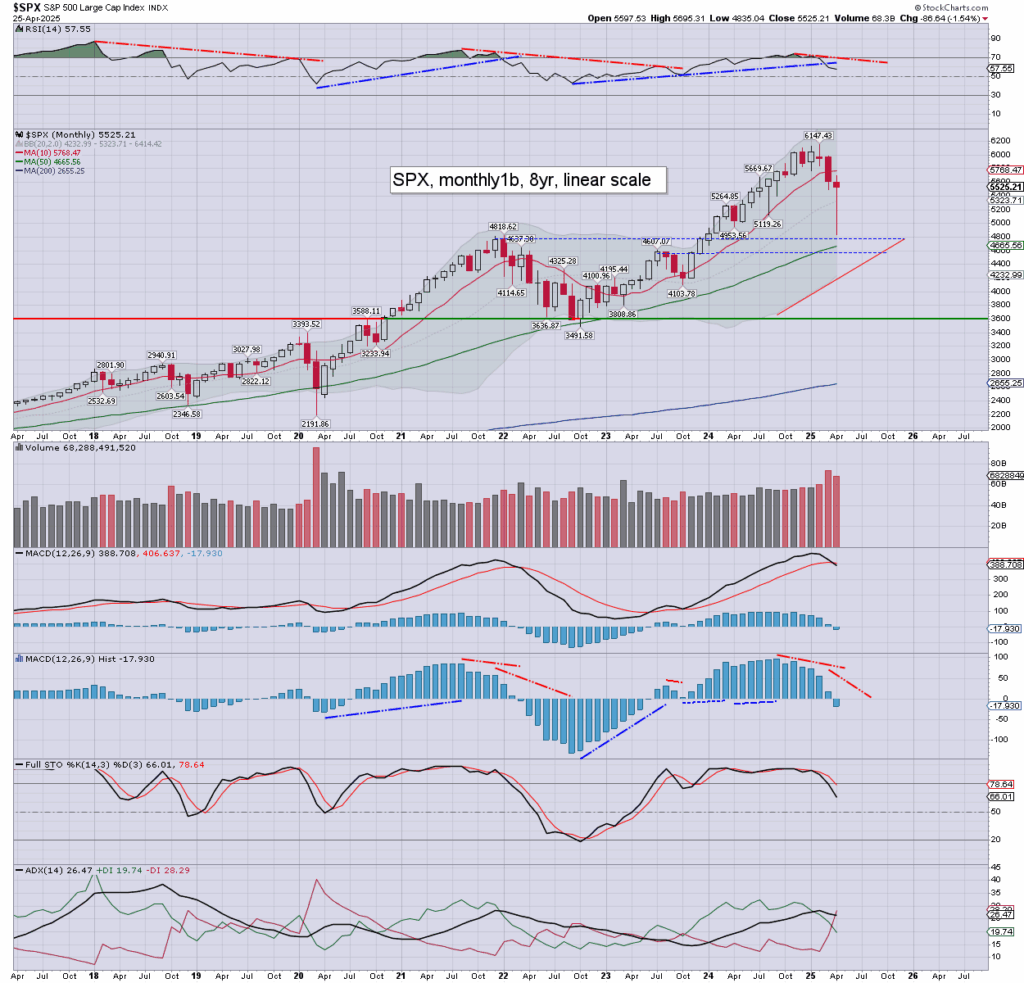

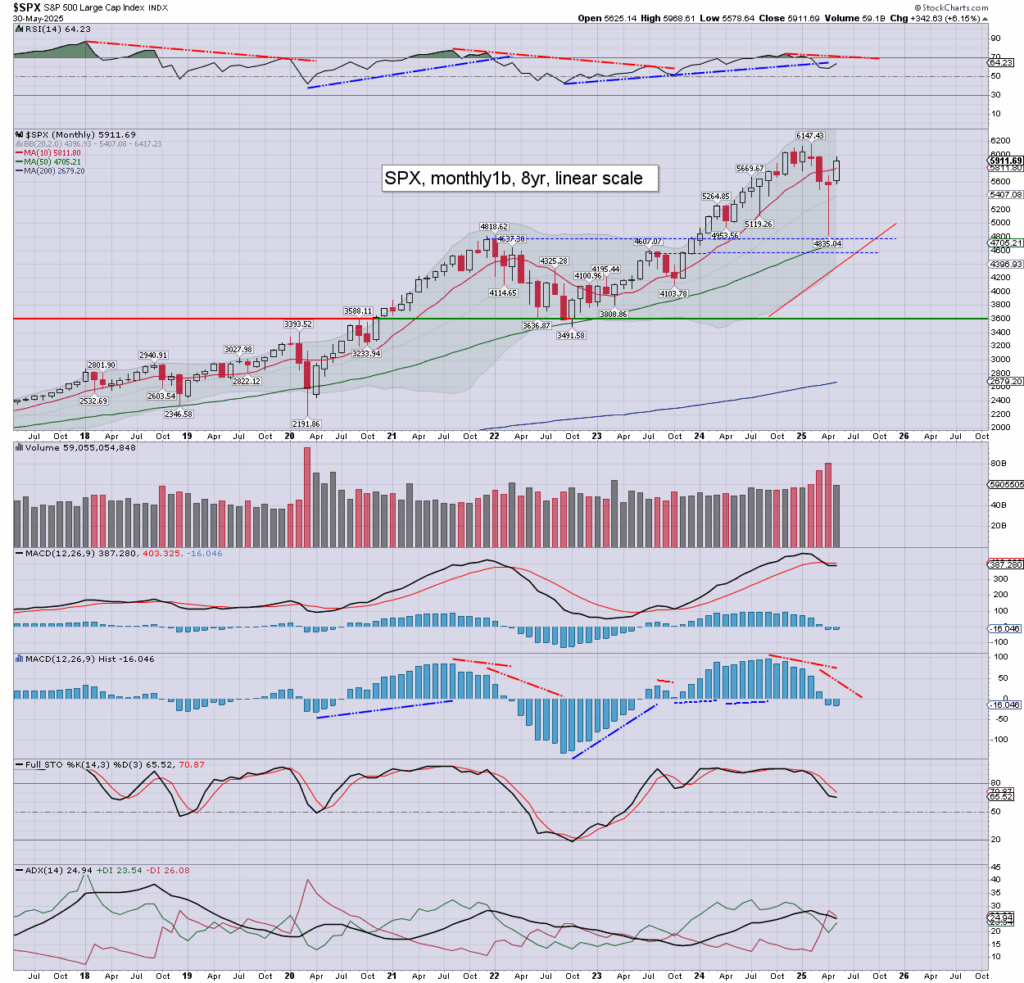

The SPX saw a net May gain of +342pts (6.1%) to 5911. Momentum ticked a touch lower, and remains marginally negative. A monthly settlement back above the key 10MA (5811), as the s/t trend has to be seen as bullish.

Natural upside resistance is psy’ 6K, and then the February historic high of 6147. Having put in (April 7th) a hyper spike floor from 4835, the market has a reasonable chance of net upside into mid August. Beyond Labor day, the bears will have into mid/late October.

It should be clear though, the day to day action will be prone to further jumps or spirals on tariff related headlines. If anything, we’ll need considerable popcorn across the summer, and into the fall.

–

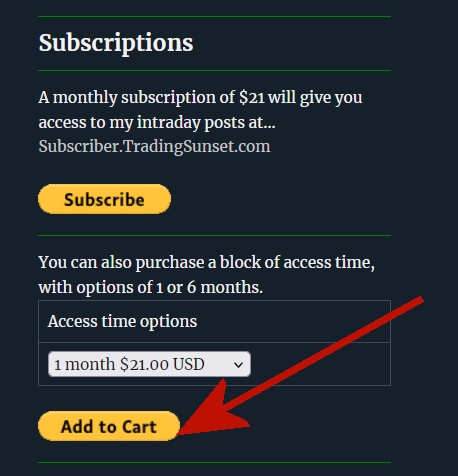

Subscription offer

Buy one month… get the second month free.

Just purchase one month of time, and I’ll credit you two!

Notes…

You should not (normally) need a Paypal account.

Offer is valid until midnight EDT, Sunday, June 29th 2025

Near the end of your second month, I’ll email you, and make you an offer to continue.

Special note… please provide an email address that you regularly use, when you subscribe, so I can send your account login details!

If you have any issues or questions, email me.

> https://www.tradingsunset.com/contact/

Yours… charts 24/7/365