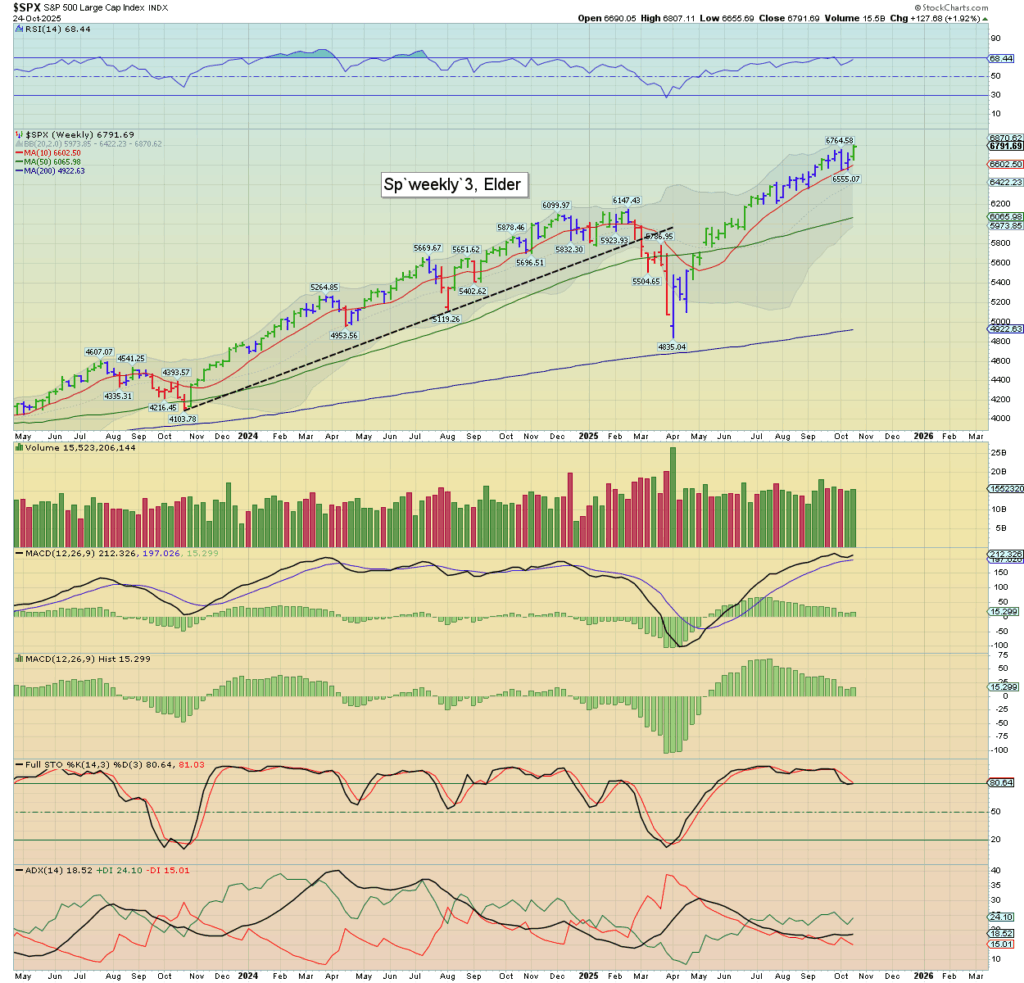

US equities ended a bullish week on a bullish note, the SPX printing a new hist’ high of 6807, settling +53pts (0.8%) to 6791, which made for a net weekly gain of +127pts (1.9%).

The weekly Elder candle was green, the first in five weeks.

Since the April low of 4835, its been nothing but greens and blues. We’ve not had any reds, as the US equity market remains short/mid/long term bullish.

A line in the sand?

There are a fair few break lines. On a weekly chart… the obvious one is the weekly 10MA, currently 6602 and higher with each week. I’d also keep in mind the Oct’10th ‘Trump tariff chatter’ low of 6550.

Equity bears now face the problem that their ‘seasonal prime time’ expires as of around Halloween. Typically, the market will lean upward from early November all the way into mid January.

Few of you will care… but…

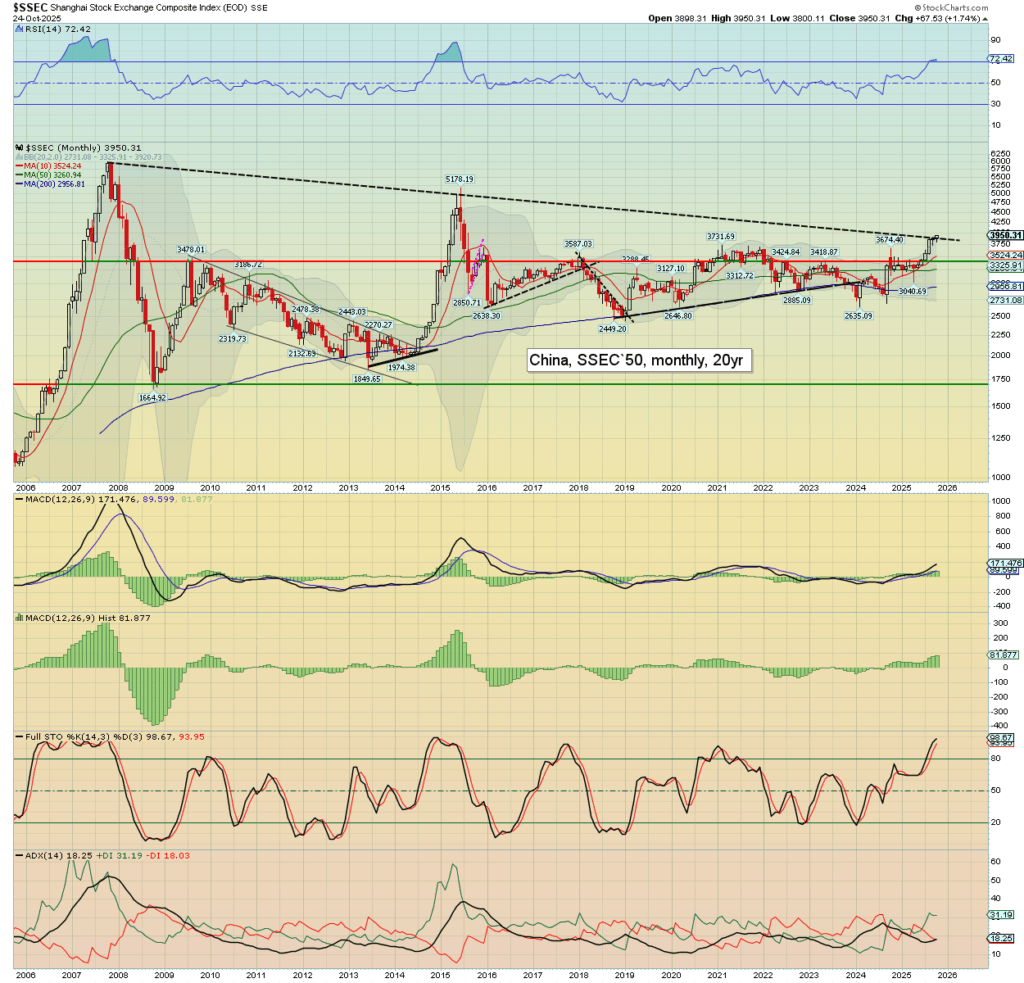

The Shanghai comp’ is currently net higher for Oct’ by +1.7% at 3950.

The break above trend is pretty clear, and offers a grander run to 5K.

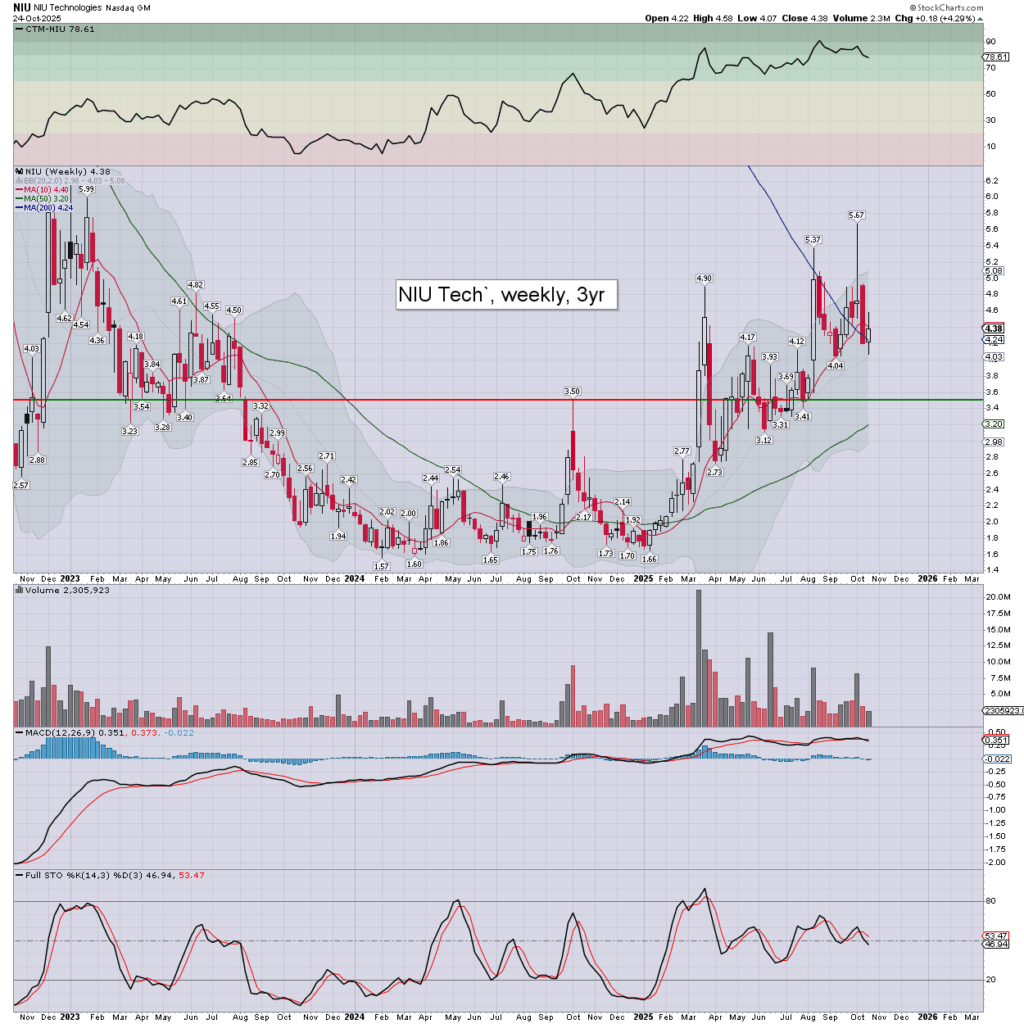

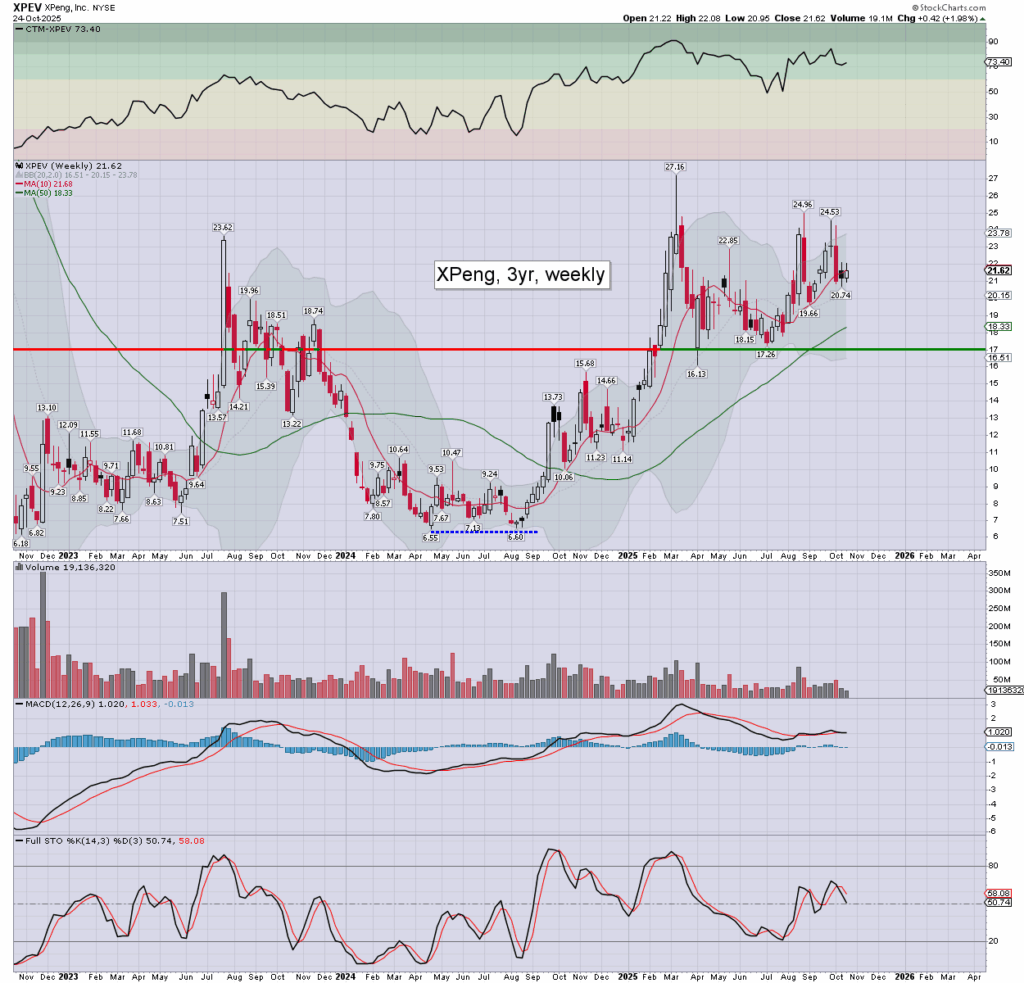

Implications… not least for NIU and XPEV.

—

Zero 7… circa 2015, before the mass societal-psychosis of 2020-22. Ohh, you didn’t really expect me to pander to the dumb vaxxed sheep… did you? Perhaps you need to return to your normal programming via FOX business or CNN.

As an increasing number recognise… its all downhill from here into the 2030s. Not all will survive, but then… most are not worthy.

—