Chart pack – Miners, gold, silver

Stocks: AEM, NEM, B, PAAS, AG

Commodities: Gold, Silver

PDF > Chart packs miners gold silver Aug2

—

Chart pack – Miners, gold, silver

Stocks: AEM, NEM, B, PAAS, AG

Commodities: Gold, Silver

PDF > Chart packs miners gold silver Aug2

—

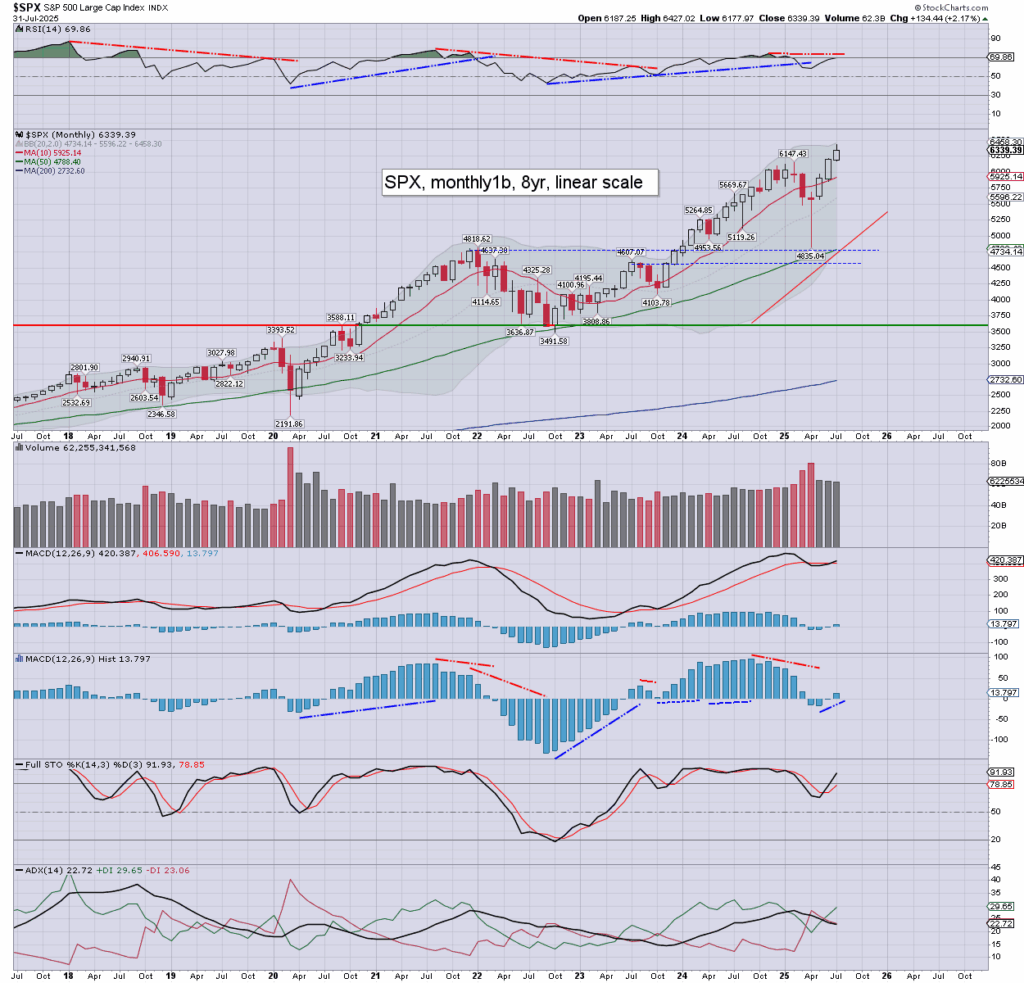

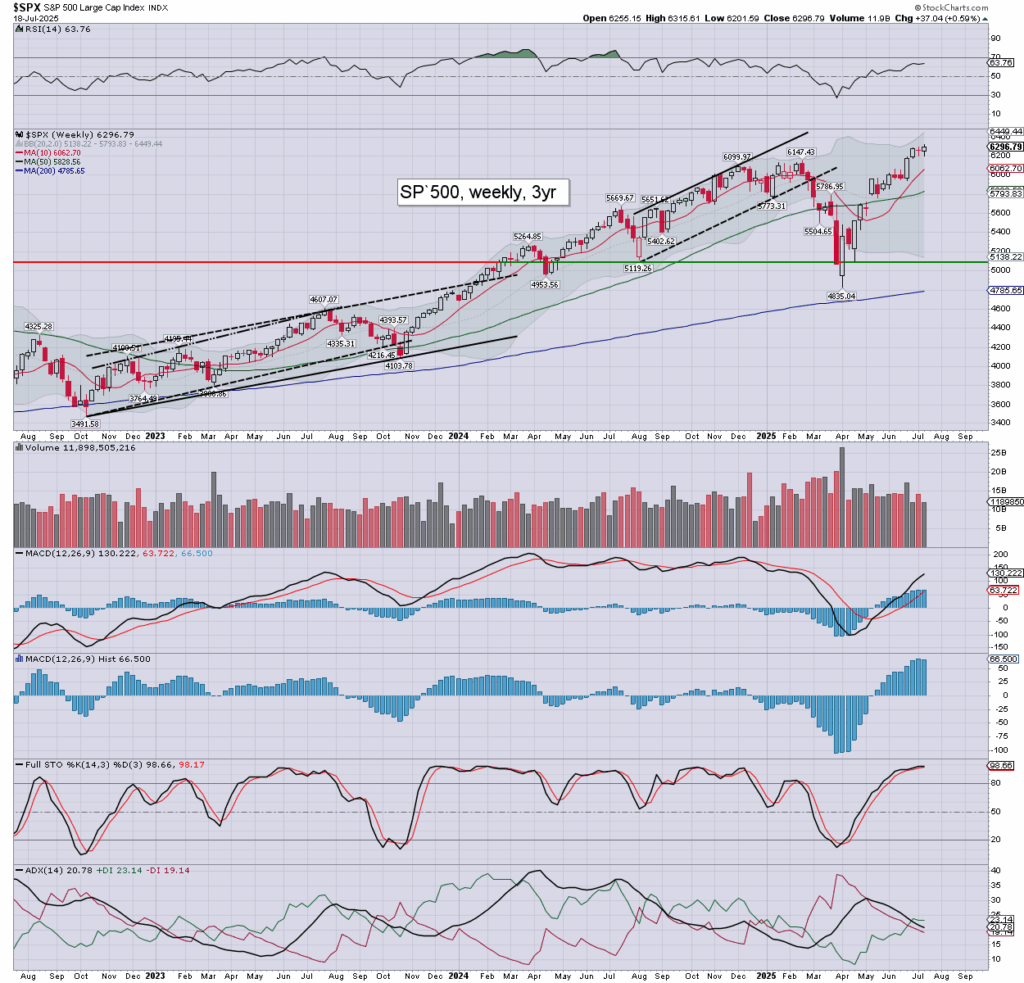

A third consecutive net monthly gain, having printed a new hist’ high of 6427. Monthly momentum ticked upward. Another settlement above the key 10MA (5925), as the m/t trend has to be seen as bullish. Whilst the July candle is spiky from around the upper bollinger, I’d be open to another 1-3% of upside ahead of Labor day.

Basic target in a correction will be the 5800s, as look realistic within October.

–

For more of the same… subscribe!

Yours… charts 24/7/365

Dear reader

As you are aware, the UK has been proceeding along a dark path for many years. Millions have migrated… mostly without permission. Some (but certainly not all) are the lowest of social strata. They raid shops… and no one stops them. They assault innocents, male, female, young, old, Christian, Jewish, Hindu… almost everyone is on their target list.

Worse though, successive UK regimes have increasingly pushed back against anyone calling out, what is an effective invasion.

Those highlighting or discussing migrant/invasion stories, are being put onto a government watchlist.

Online clampdown

As of Friday July 25th, the ‘Online Safety Act’ has been enacted. Thousands of websites are behind an ‘ID required’ wall. Even left leaning liberal websites like Wikipedia have been blocked.

As some recognise, it was never about preventing children from viewing adult websites, it was always about mass censorship, especially in terms of coverage about the invasion.

In the past few days…

Just a little west of me, a man in his sixties was raped… on church grounds.

Yet… the London Metropolitan Police – or rather Stasi-Pigs, are far more concerned about people posting comments than the rapist.

–

I hold the policy that if the Stasi-Pigs knock on my door, I will not let them take me alive.

Its better to die, than allow myself to be seized, drugged, raped, and likely murdered in a jail cell. The London Met’ Police have a long history of this type of abuse, and this is increasingly the case, as they hire migrants who despise the indigenous population.

To disappear

If I disappear for more than a few days, then you can assume I received a knock from the Stasi-Pigs, and decided to prevent them from seizing me.

As things are, the probability of this is around 20% (within any given week), and rising.

If you read around, you may be aware of the following…

Herr Starmer is set to initiate OPERATION ROUNDUP. Tens of thousands on the primary watchlist are to be taken to camps, of which seven are planned. There will no exits from such places.

The broader aim is for hundreds of thousands to be ‘removed from society’, or rather… killed by the state, which would be more than enough to dissuade anyone else from rising up against Starmer’s tyranny.

If you think a European leader won’t initiate genocide against his own people, then I refer you to that megalomaniac in 1930/40s Germany. It has happened before, and appears set to happen again.

For now, many would deride such talk, but those are the same people who still think the mRNA shots are ‘safe and effective’, and that a government would never turn on its own people.

–

I will endeavour to work, but I wanted to let you know… in case.

Those of you in the United States, I truly envy you.

At least you have hope.

Here… its only going to get considerably worse.

Wherever you are, I wish you well.

Yours… P

It was another net bullish week in equity land, with the SPX having printed a new historic high of 6315. The bigger weekly and monthly charts are both offering the 6400s, and around 6500 by Labor day.

Gross complacency?

Yes, the mainstream sentiment is grossly complacent about multiple economic and geo-political threats. The housing market isn’t great, and many companies are firing people by the thousand. There is Ukraine/Russia, Israel/Gaza, and lets not forget China/Taiwan.

For now though, Mr Market doesn’t particularly care. Instead… the market is hoping for rate cuts (and arguably renewed printing), not least once Powell has been replaced.

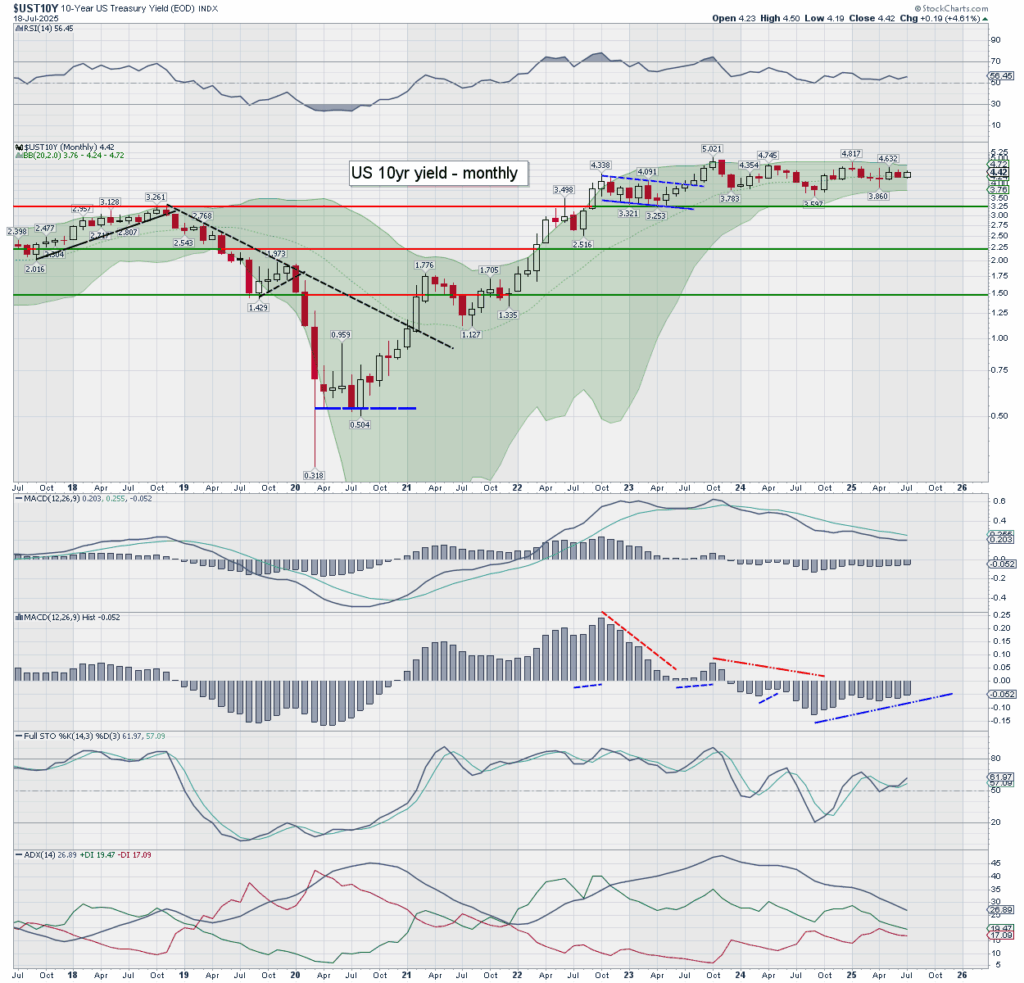

My concern into the Fall… is the bond market. Despite President Trump stating he wants interest rates to 1% or lower, I’d be mindful that the bond market might have other ideas.

The US 10yr yield stands at 4.42%. Broadly… its been chop for around three years, and I’d be the first one to state… bullish >5.00%, and bearish <3.25%

With the ‘big beautiful bill’, or arguably ‘abomination’, having been passed, annual deficits will remain high, with the federal debt mountain likely to hit $50trn by 2030/32.

My inclination is to see a bullish breakout in the US 10yr >5.00%, and then onward to 7%. If you think that is ‘crazy talk’, well, I refer you to Dimon of JPM, who appears also to be leaning in that direction.

Monthly momentum in yields is highly prone to turning positive in Sept’ or Oct’. If that happens, its difficult not to see >5.00%, in which case all aspects of the capital markets are going to have to adjust.

–

Two interesting things…

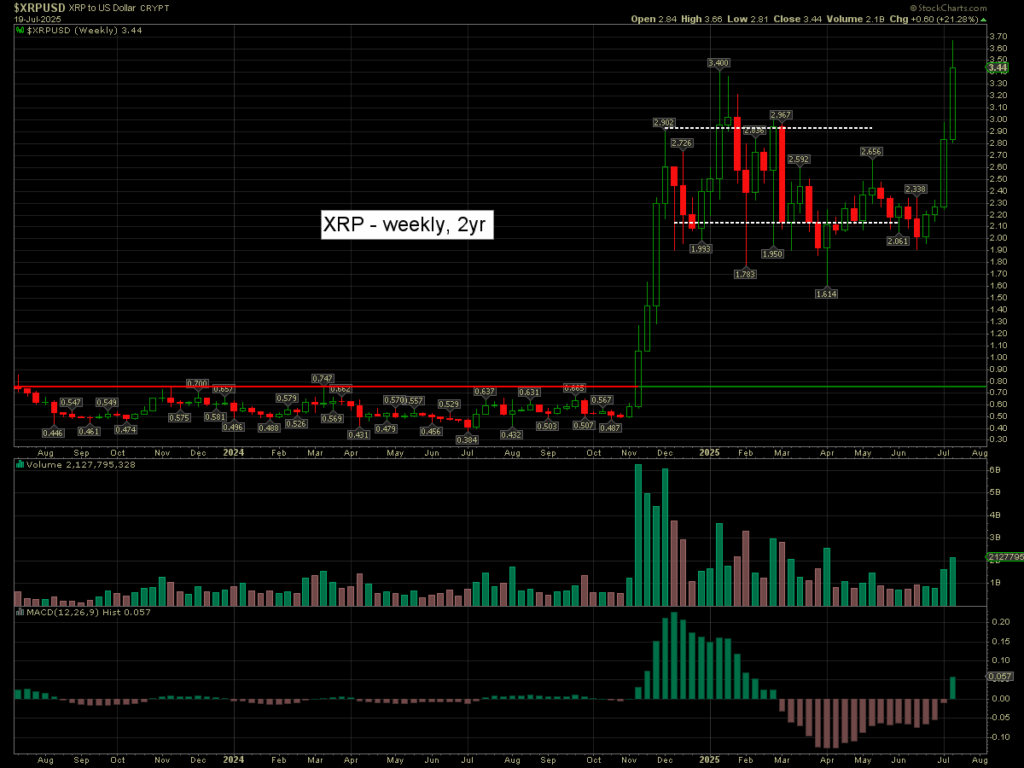

Crypto – XRP

XRP broke a new hist’ high of $3.66 on Friday. I’d note weekly momentum has turned positive for the first time since late February. A multi-month push to $10 looks an eventuality.

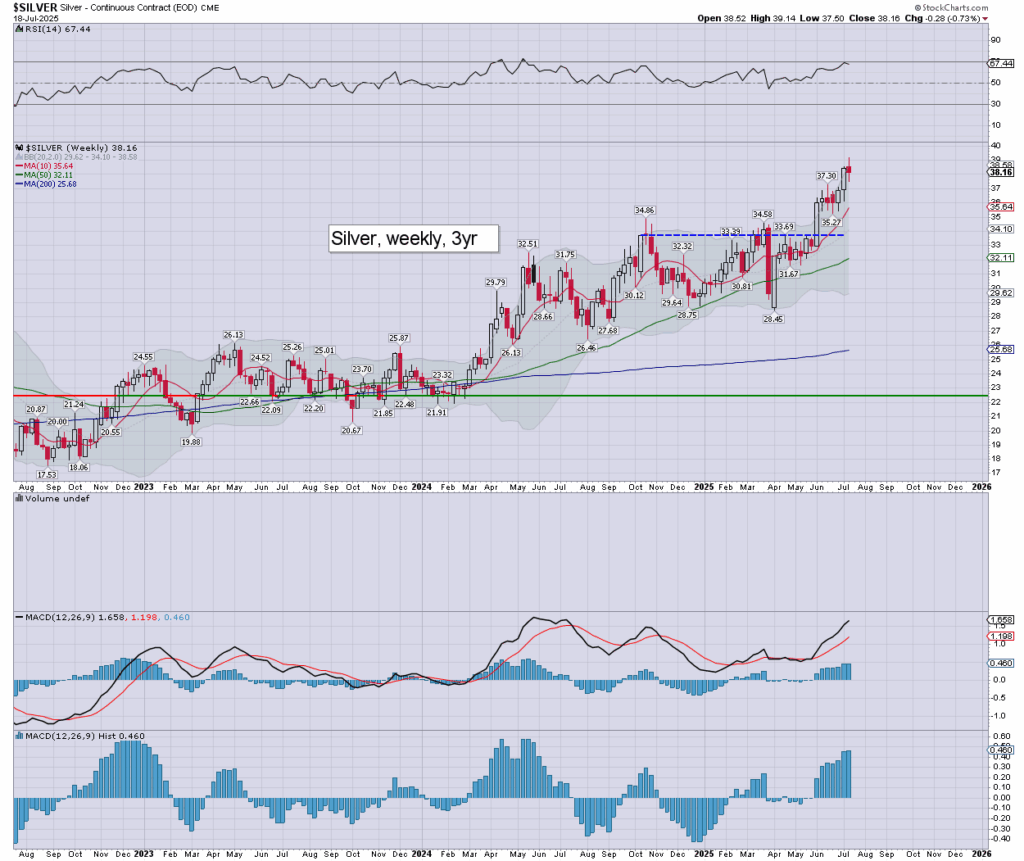

Commodities – Silver

This week saw silver print $39.14, the highest since Sept’2011. There is another 26% until a challenge of the 1980/2011 double top of the $49s.

–

Yours truly remains independent, which is a rarity these days. I’m not beholden to anyone, and I can call it as I see it. If you value such a thing, then now is the time to subscribe…

Subscription offers

6 months (+1 free) at $21 a month for $126

https://buy.stripe.com/4gM5kD7Zy4Dp0Xja3Absc04

12 months (+3 free) at $19 a month for $228

https://buy.stripe.com/5kQfZhcfO2vhdK5cbIbsc06

Notes:

-Payment is in one lump sum.

-Offers valid until midnight EST, Thurs’ July 31st 2025.

You’re welcome to also pay using Paypal, not least if you’d instead prefer a monthly subscription.

> https://www.tradingsunset.com/subscriptions

—

Yours… philip

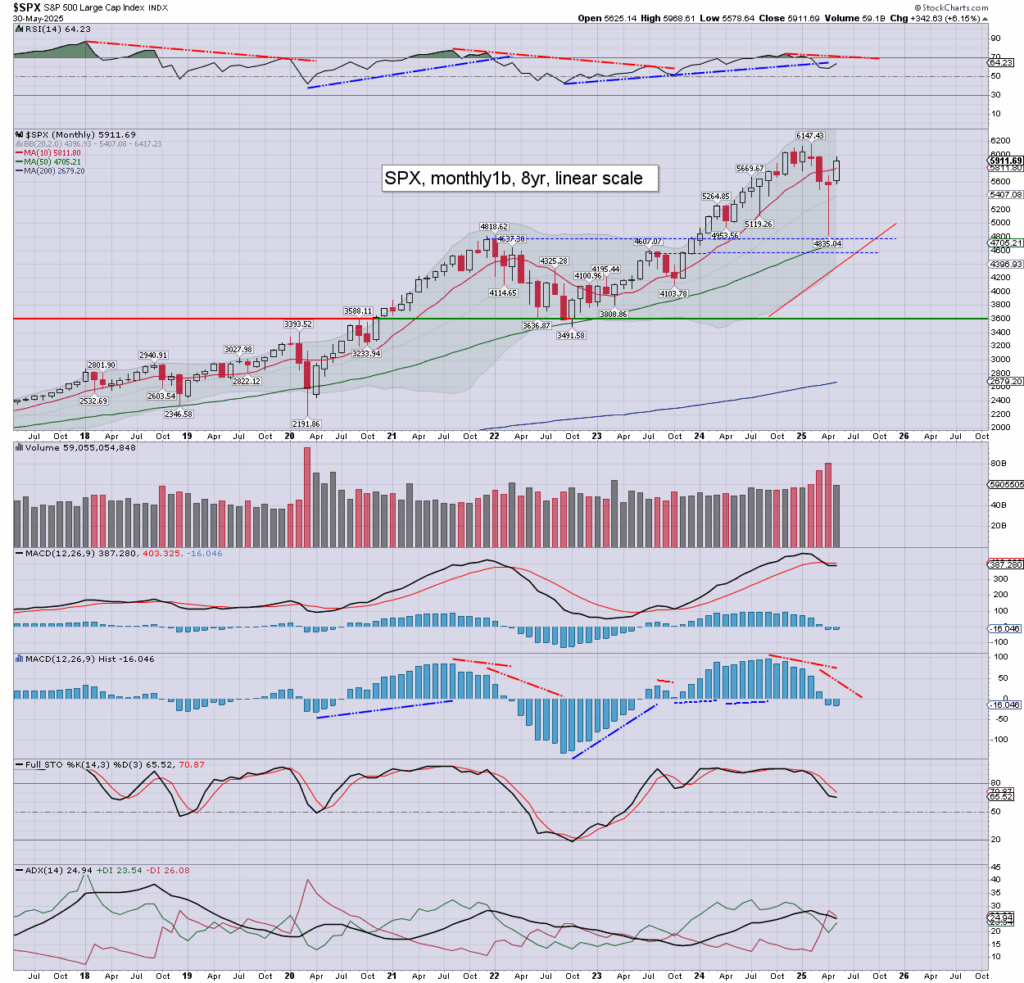

The SPX saw a net May gain of +342pts (6.1%) to 5911. Momentum ticked a touch lower, and remains marginally negative. A monthly settlement back above the key 10MA (5811), as the s/t trend has to be seen as bullish.

Natural upside resistance is psy’ 6K, and then the February historic high of 6147. Having put in (April 7th) a hyper spike floor from 4835, the market has a reasonable chance of net upside into mid August. Beyond Labor day, the bears will have into mid/late October.

It should be clear though, the day to day action will be prone to further jumps or spirals on tariff related headlines. If anything, we’ll need considerable popcorn across the summer, and into the fall.

–

Subscription offer

Buy one month… get the second month free.

Just purchase one month of time, and I’ll credit you two!

Notes…

You should not (normally) need a Paypal account.

Offer is valid until midnight EDT, Sunday, June 29th 2025

Near the end of your second month, I’ll email you, and make you an offer to continue.

Special note… please provide an email address that you regularly use, when you subscribe, so I can send your account login details!

If you have any issues or questions, email me.

> https://www.tradingsunset.com/contact/

Yours… charts 24/7/365