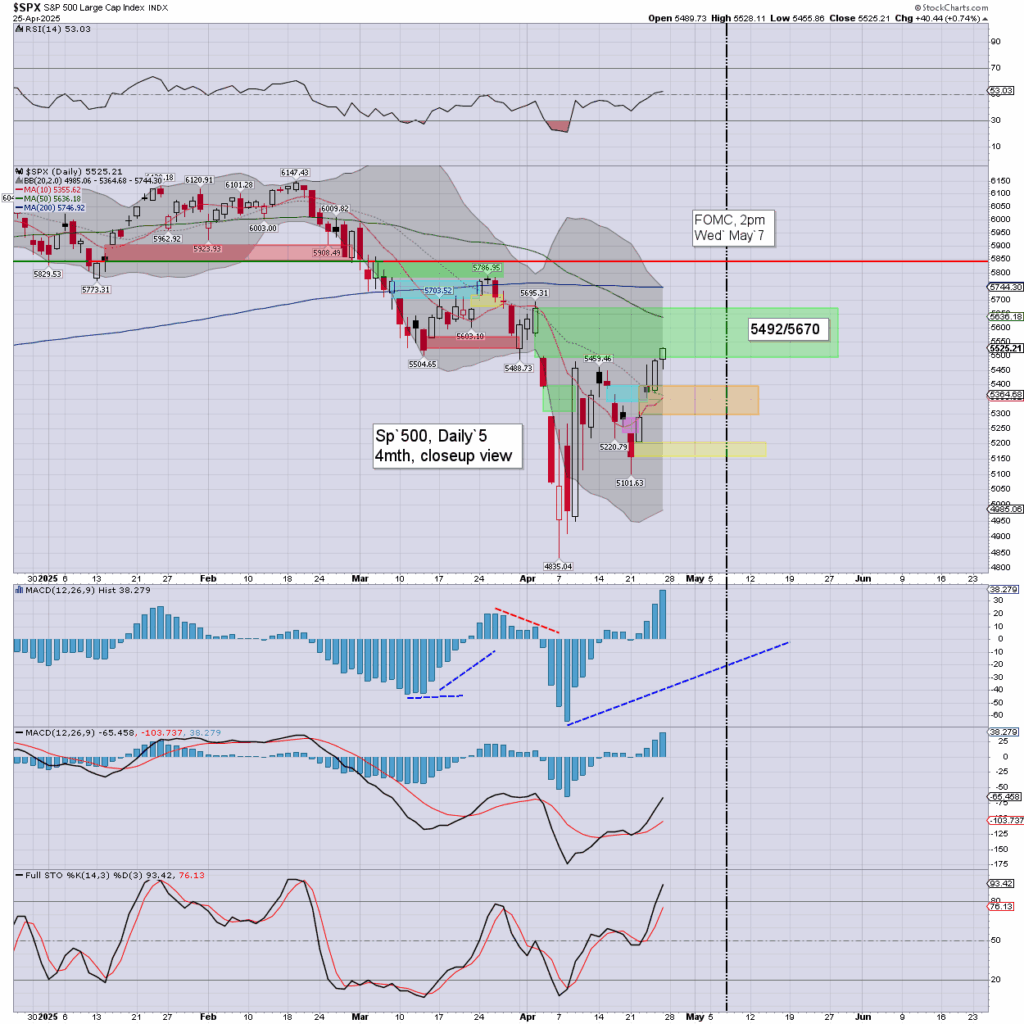

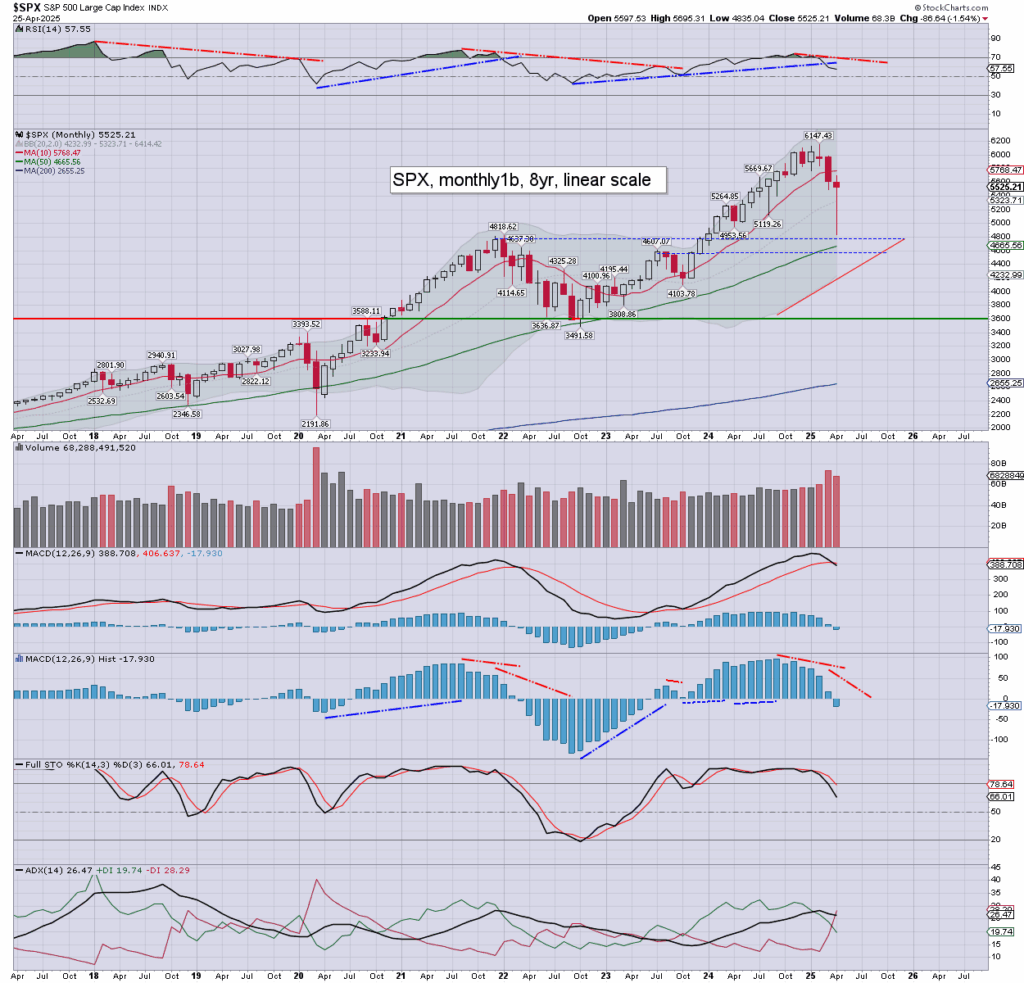

The SPX has climbed from an April 7th low of 4835 to 5528. That is some 693pts (14.3%) across just fourteen trading days.

On any basis… its been one dramatic April. Mr Market has managed to washout a great many of the m/t bulls, whilst then also washing out most of the s/t bears. Its been normal service… in some ways.

Now its merely a case of whether we stall from within the 5700/800s, and eventually break <4835, or we continue to recover upward, and break a new hist’ high (>6147) this summer

My guess… remains the former. That view would be dropped on any sustained price action >5850, which would be decisively back above the monthly 10MA and the daily 200MA.

–

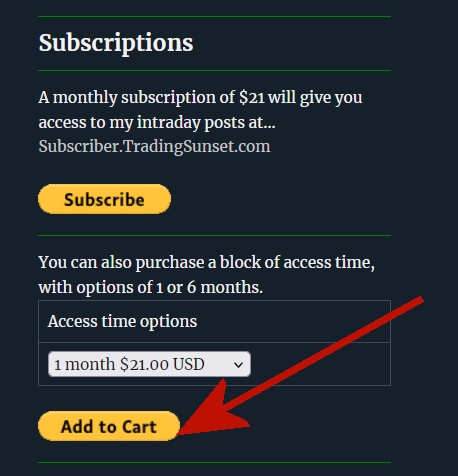

Subscription offer

Buy one month… get the second month free.

Just purchase one month of time, and I’ll credit you two!

Notes…

You should not (normally) need a Paypal account.

Offer is valid until midnight EDT, Sunday, June 29th 2025

Near the end of your second month, I’ll email you, and make you an offer to continue.

Special note… please provide an email address that you regularly use, when you subscribe, so I can send your account login details!

If you have any issues or questions, email me.

> https://www.tradingsunset.com/contact/

Yours… charts 24/7/365