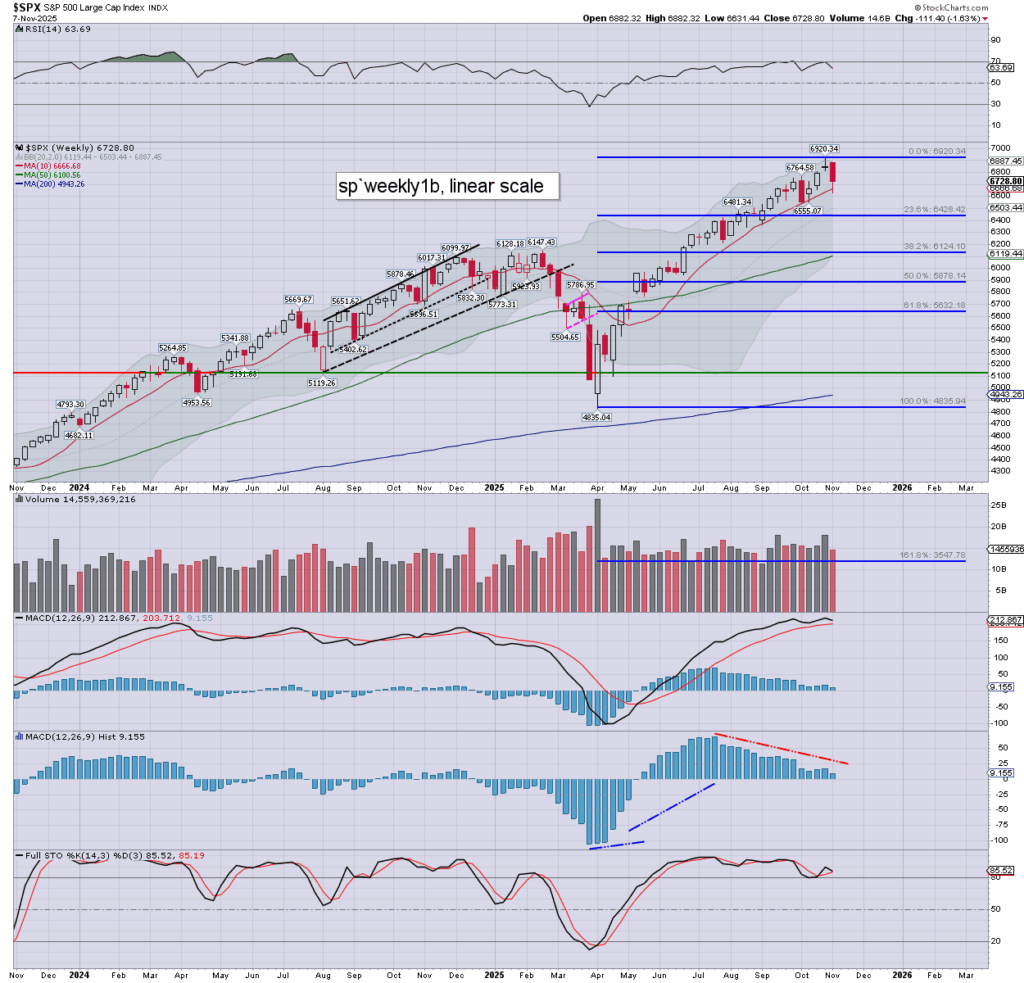

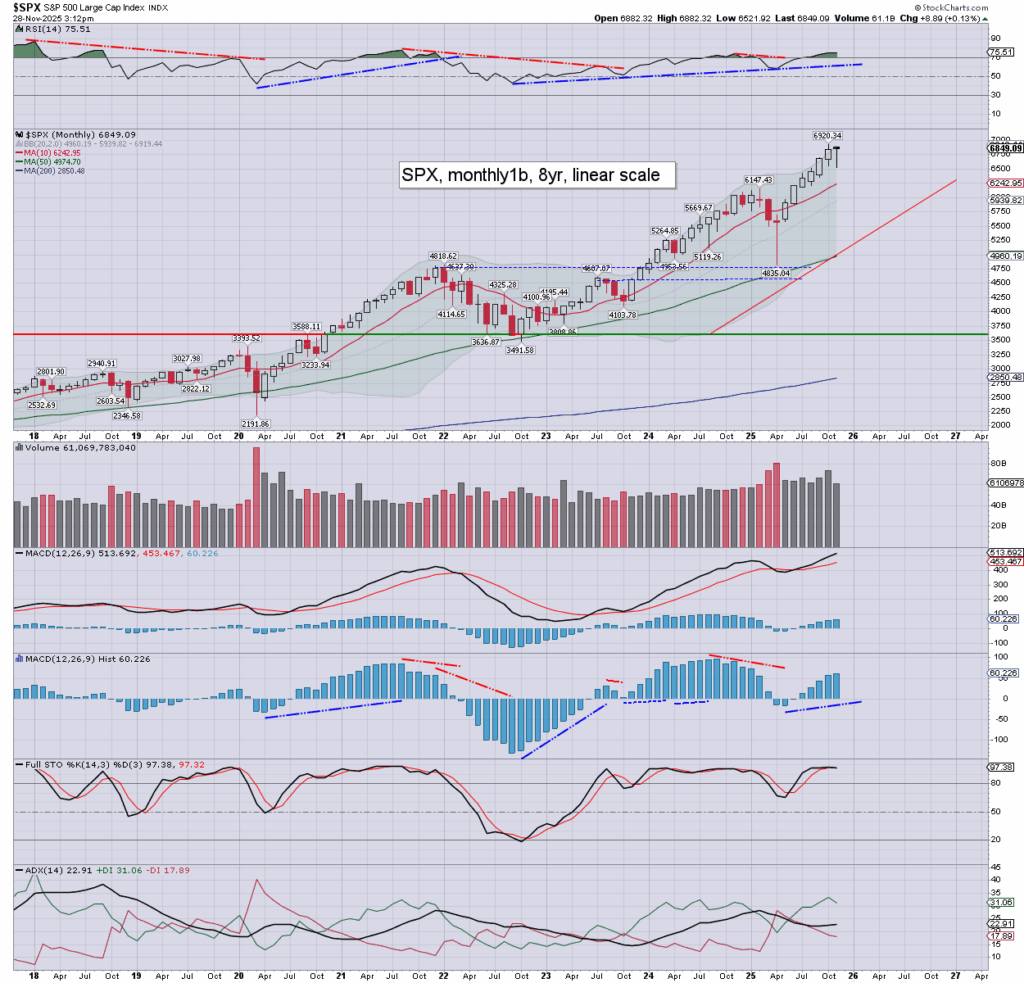

A seventh consecutive net monthly gain, if only by +0.1%. The November candle is spiky on the lower side, having recovered from 6521 to settle at 6849. Monthly momentum ticked a little higher, and is on the high side. A monthly settlement above the key 10MA (6242), as the mid/long term trend remains bullish.

–

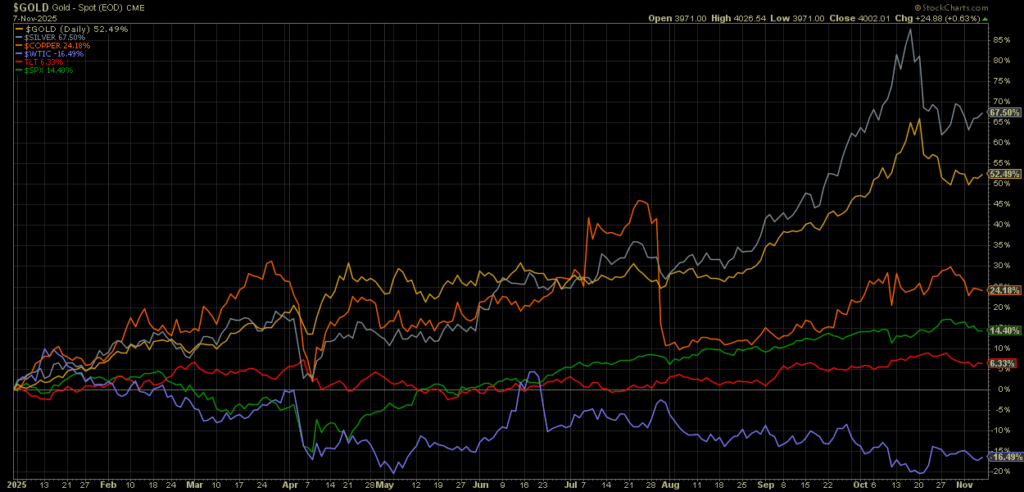

Ytd perform’, with 21.5 trading days left of 2025…

Silver +84.7%

Gold +58.6%

Copper +28.7%

SPX +15.8%

TLT +7.6%

WTIC -18.2%

2025 is clearly the year for the precious metals.

Equities have had a pretty strong year.

Bonds are up… as the Fed cut rates

The one major positive for the US/global economy… cheaper oil/gasoline.

–